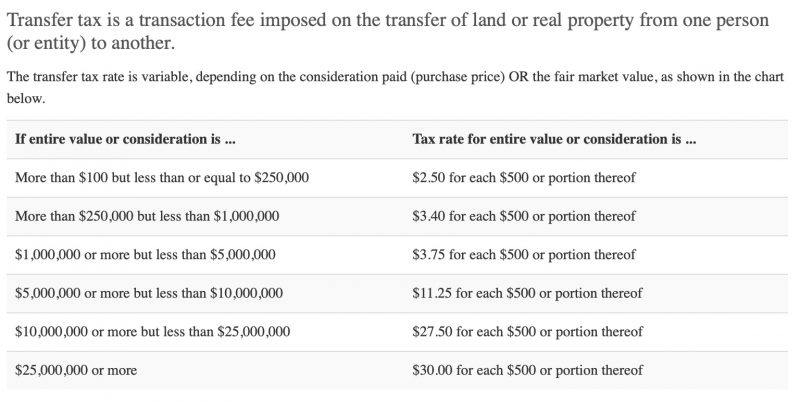

Sellers have many things to consider when they prepare to sell their home or condo. One of the expenses that can surprise some sellers is the City & County of San Francisco Transfer Tax. This hefty tax is based on the sales price and is deducted from your proceeds by the escrow company. In transactions involving new construction properties, buyers are generally required to pay this tax. (Updated March 2022)

real estate taxes

How much are property taxes in San Francisco?

I am often asked about SF property taxes, how they are calculated and when they are due. Property taxes (also known as real estate taxes, real property taxes, or secured property taxes) are calculated by taking the assessed value of the property and multiplying it by the current tax rate, as of today, the current rate is approximately 1.18%. For newly purchased properties, the assessed value is typically the purchase price. The tax bill is mailed by the tax collector once a year in the fall. You should receive the bill before November 1st. Fun fact: even if you do not receive the bill in the mail, you are still responsible to pay it.

The bill is broken into two payments, the first payment is due before December 10th and the second is due before April 10th. A penalty of 10% applies if the payment arrives late, so be sure to pay early or on time.

It is important to remember that the regular tax bill is completely separate from the supplemental tax bill that is triggered following the purchase of a property. Supplemental property tax is essentially a catch-up tax on the difference between the last assessed value and the new one (aka the recent purchase price). So if you purchased a condo for 700,000 and the most recent assessed value per the assessor’s office was 550,000 then you should expect a supplemental tax bill on the 150,000 difference. So that would look like this: 150,000 x 1.18%. There is also a variable factored in for what month your closing occurs. It often takes about 3-12 months to receive the supplemental tax bill following the purchase.

To estimate your property taxes, here is a nifty calculator.

For more details on property taxes in San Francisco, visit: https://sftreasurer.org/secured

415.971.5651

415.971.5651

patrick@

patrick@

SF Office

SF Office