If you are like most buyers today in San Francisco, you have already submitted offers (and were outbid) on more than one property. In this fiercely competitive market, buyers are routinely competing for the best properties. Only the most creative and aggressive buyers are able to get their offer accepted. Since the market is so competitive, it is important to make your offer ultra compelling to a seller. Below are some tips that will help:

1. Assuming there is serious competition for the property you want, submit your highest and best offer right out of the gate. While counter-offers are certainly possible, they are less common in highly competitive situations. After your initial offer, you will most likely not be given a second chance on a popular property.

2. Conduct property inspections before you submit an offer or rely on the inspections provided by the seller. Putting an inspection contingency clause in your contract is possible however it reduces the overall attractiveness of your offer.

3. Know the sellers’ situation. Do they need a rent back period because they’re looking for another home? Are they doing a 1031 exchange? Is the home being sold by a family following the death of the owner? Knowing the circumstances of the seller may help you to structure your offer in a way that is more likely to be accepted.

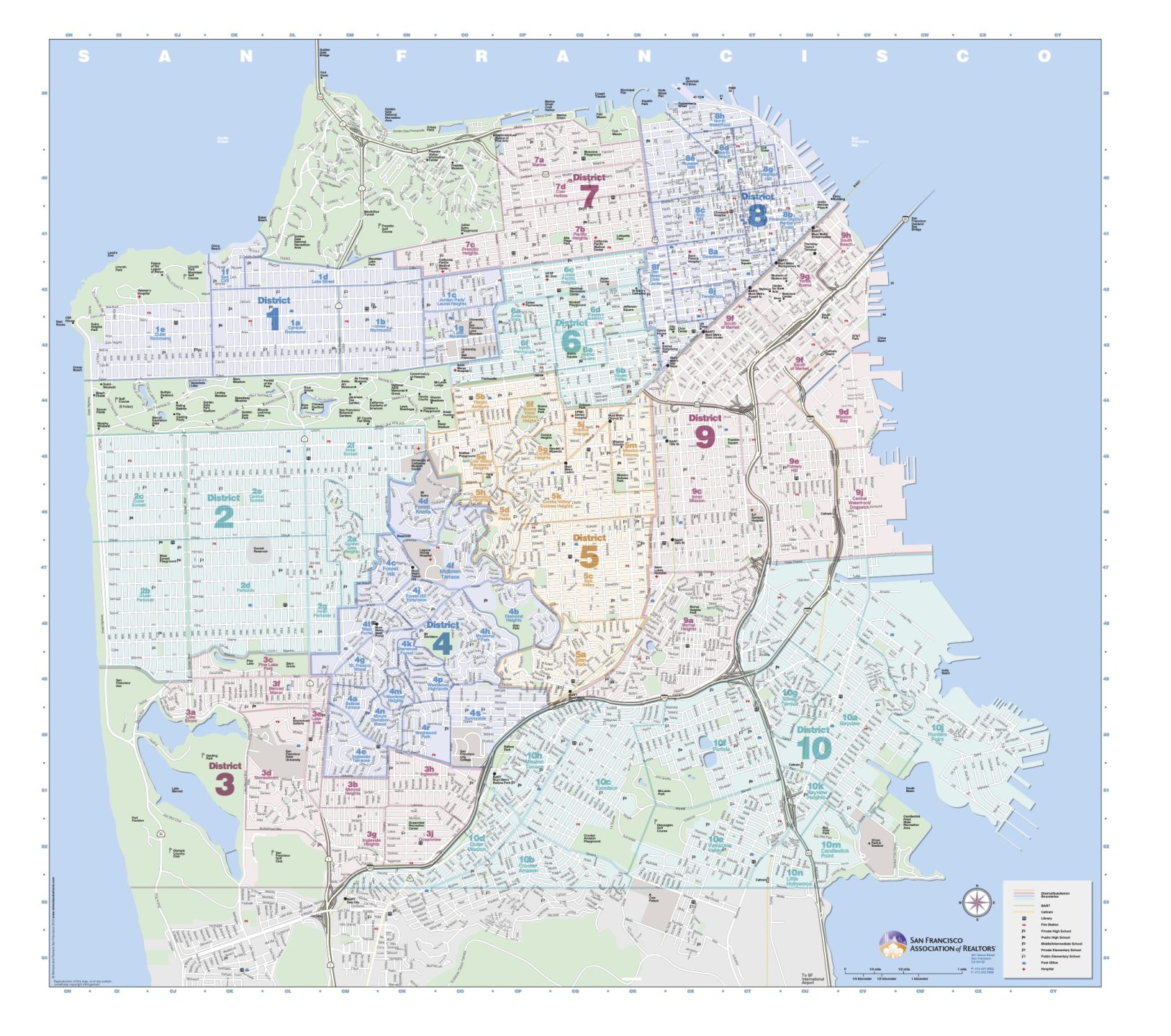

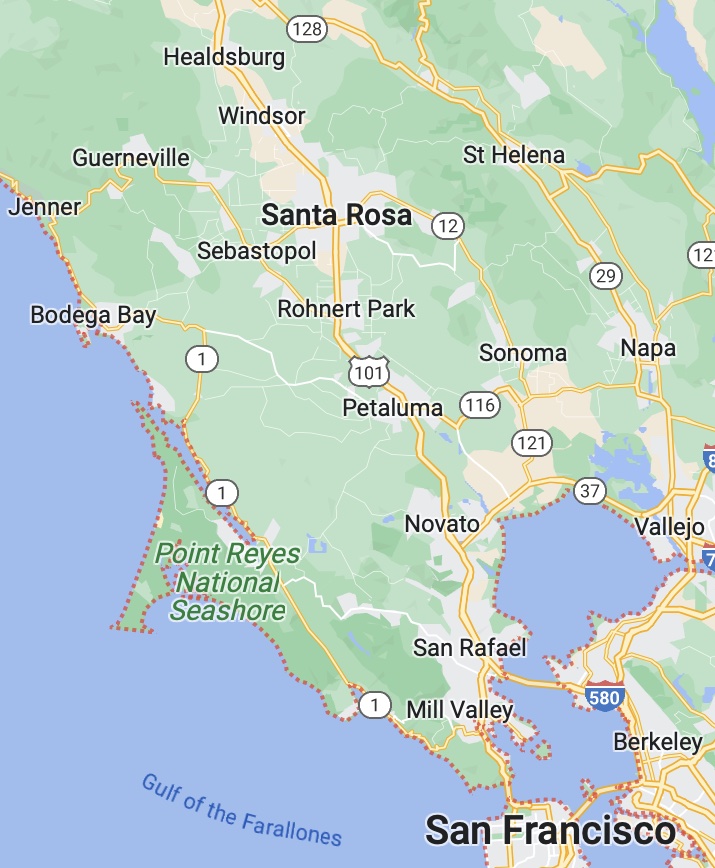

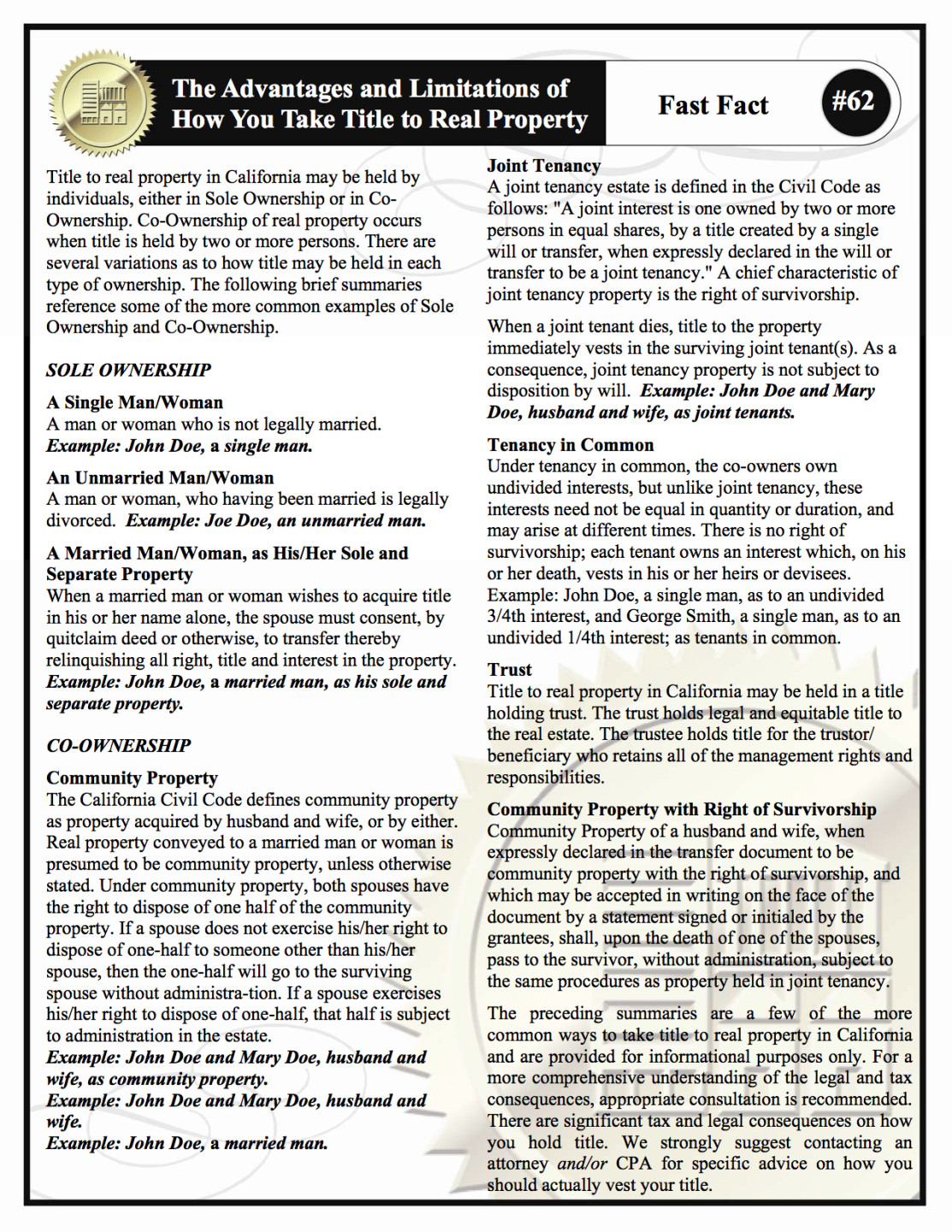

4. Make sure you are being represented by an experienced local San Francisco real estate broker who knows the market. The nuances of the real estate market in SF are significant and very unique to our city. The idiosyncrasies surrounding topics like offer dates, mortgage underwriting, disclosure packages, termite inspection reports, rent control, local professional inspectors, energy & water conservation rules, and condo conversion can all make or break your transaction. Be sure you are being represented by a local San Francisco real estate broker who knows what they’re doing.

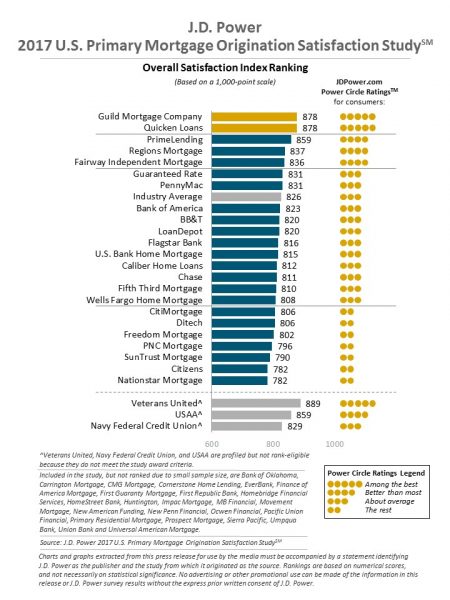

5. Like it or not, you will probably be competing with all-cash buyers. Cash offers are of course very appealing to a seller. If you are like most people however, you’ll need to get a mortgage; get fully underwritten in advance by a local mortgage broker. I do not recommend going through a big bank for your mortgage. The underwriting process at the giant brick & mortar banks is typically extremely time-consuming. It moves much slower than the brief timelines that are customary in our brisk purchase process in SF. That can push you in to a stress spiral at the 11th hour when the bank is dragging their feet on issuing your final loan approval while the seller is demanding that you remove your loan contingency (that contingency is what protects your deposit). Mortgage brokers generally are able to communicate with loan processors and underwriters so that they can get things moving along should any approval issues arise. Mortgage brokers coordinate loans through many sources, so if one lender will not loan at terms that work for your situation, it’s likely that he or she can find another one that will. Your real estate broker can recommend solid mortgage brokers, just ask.

6. Include a personal letter to the seller with your offer. Tell the seller about you and why you love the home. Connect on an honest and personal level. I have seen buyers prevail because of a letter, even when their offer was not the highest one received.

415.971.5651

415.971.5651

patrick@

patrick@

SF Office

SF Office