We’ve put together a map of current home prices in each SF neighborhood. I hope you find it helpful!

Author: Patrick Lowell

Monthly Sonoma County Real Estate Report

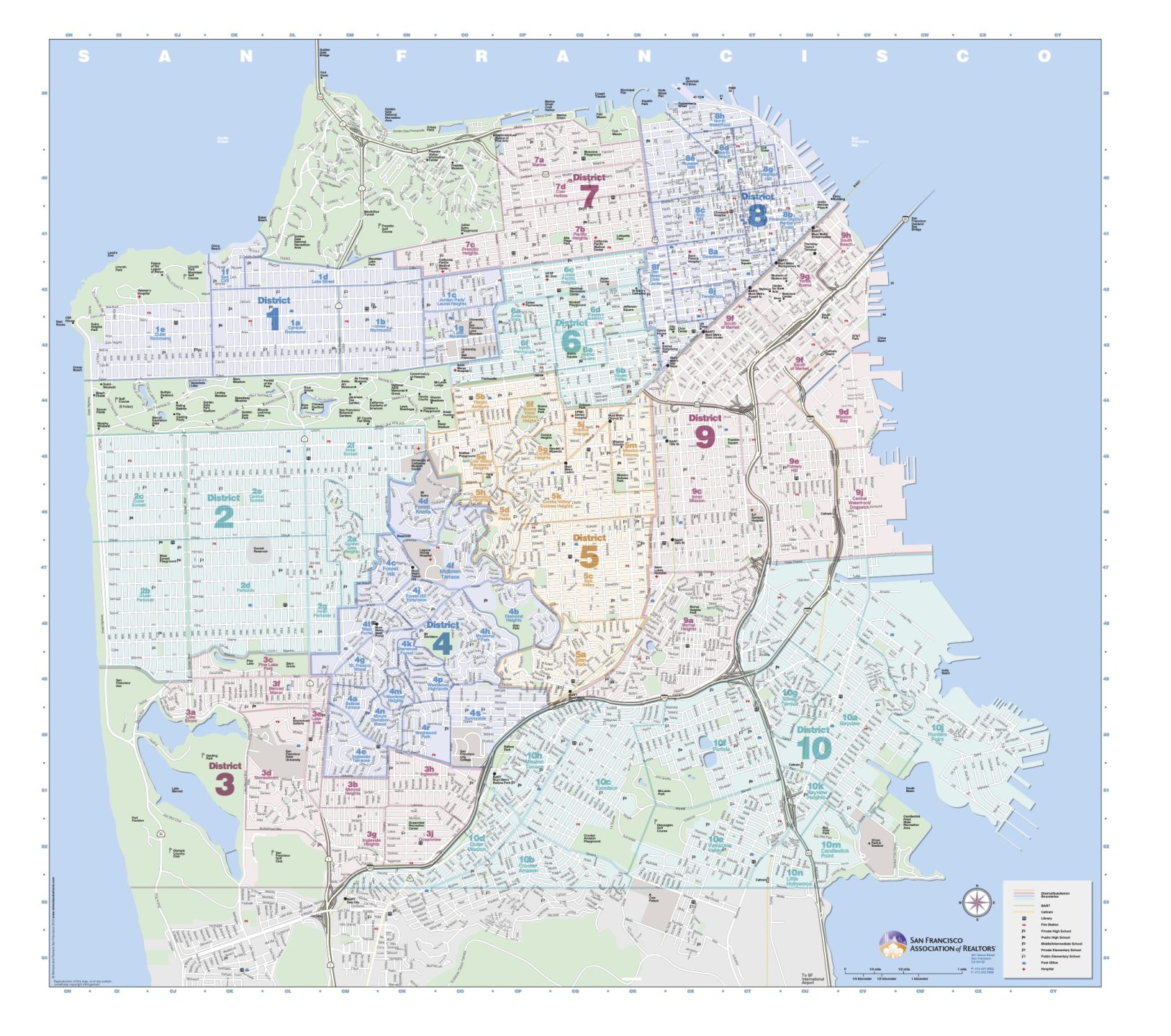

Making sense of San Francisco’s MLS district map

If you’ve been considering buying or selling a home, you’ve probably heard about MLS (Multiple Listing Service). Every region of the country has its own MLS which is the central database of all property listings in a particular area. The San Francisco MLS is SFARMLS. The MLS for Wine Country and Marin is BAREIS. The vast majority of property listings that you see on real estate websites all originate on the regional MLS.

San Francisco is a small densely-packed city with houses, condos, multi-unit buildings, and TICs spread over a small 7 mile x 7 mile area. To organize all of those properties geographically, the San Francisco MLS has 10 districts and 89 sub-districts. Here’s a link to the official SFAR MLS district map.

I recommend searching MLS through Compass.com which allows you to see every listing available with every real estate company in the city. In addition, if you are not already working with an agent, my team and I will create a Collection for you which is a dynamic online board of properties that meet your specific criteria. It allows you to message me about a home in the app in real time, no need for lots of extra text messages or emails.

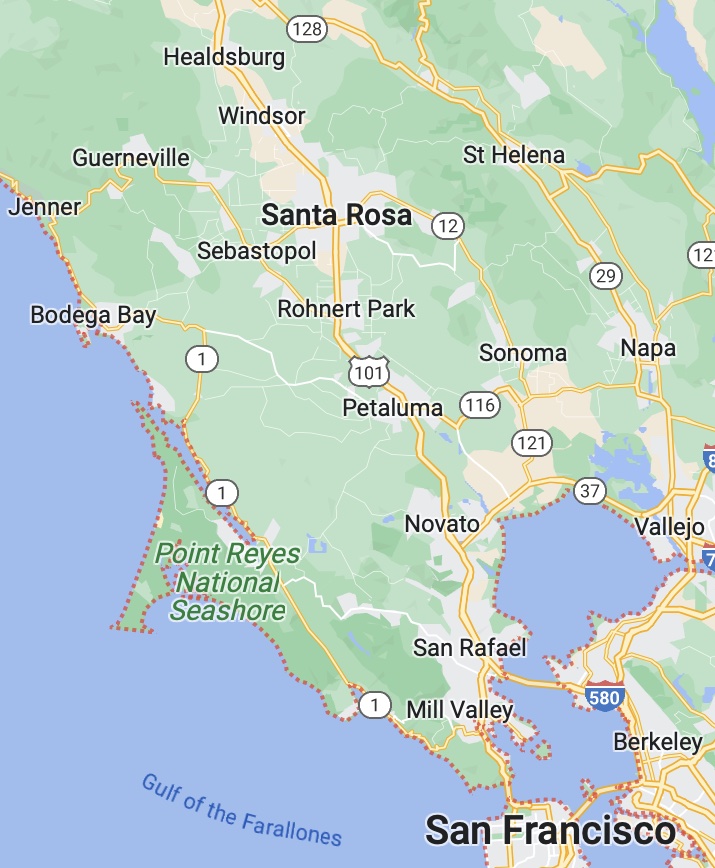

Did you know that I also represent clients in Wine Country? Here are some Sonoma County Wine Country listings currently available. This is just a sample, we have access to many more properties in the area.

Let me know if you are looking for a particular town in Sonoma County or specific price range and I’ll get to work on it.

We also have Private Exclusives which are off-market properties, they are at the request of the seller usually due to privacy reasons or other unique situations. Private Exclusives are only viewable to Compass agents and clients. Call me to check if we have anything that may fit what you’re looking for.

Whether it’s San Francisco, Marin, or Wine Country, my team and I are here and ready to help.

(Updated August 22, 2024)

What is a disclosure package?

If you have spent more than a day searching for a place in San Francisco, you have probably heard the term “disclosure package”. When a seller prepares their home for sale, they are guided by their listing agent through an important but rather lengthy disclosure process. As the name implies, disclosures are documents that give prospective buyers more information about a particular property. If the seller knows of a material fact about a home, they are obligated to tell the prospective buyer about it.

The contents of a disclosure package usually include a variety of statements and mandated reports. Often these include: home inspection report, termite inspection report, preliminary title report, history of permits, natural hazard report, condo rules & restrictions, underground tank inspection, seller’s transfer disclosure statement, and many more. Most residential sales in SF are “AS IS”, meaning that the buyer is taking the property in it’s current condition and accepts the disclosures as they are, including the imperfections. It is therefore very important for buyers to read and understand the entire disclosure package before submitting any offer. Sellers are wise to disclose everything to buyers in advance to avoid any re-negotiation resulting from undisclosed issues during the inspection and sale process.

If you have found a property you love, your agent can get the disclosure package for you, just ask. Keep in mind that packages can be 100-300 pages in length, so you may want to be careful how many you request. Interestingly (at least to me), SF is one of the few cities where sellers and agents prepare a disclosure package up front before a home hits the market. Real estate custom in most other cities is that agents and sellers wait until a buyer is in contract before they prepare the reports and disclosures.

A sample disclosure package cover sheet:

Condo, TIC, Co-op. What are the differences?

What’s the difference between a condo, a TIC, and a co-op? No doubt you’ve heard of each of them but if you are like most people, you’re not sure about the specifics.

What’s the difference between a condo, a TIC, and a co-op? No doubt you’ve heard of each of them but if you are like most people, you’re not sure about the specifics.

Generally speaking, if you are looking to buy a place to live in San Francisco (and it’s not a single family house) then you are probably talking about one of these three forms of ownership. Since these are forms of ownership and not styles of construction, you can’t tell these buildings apart by physically looking at them. Here are the primary differences in how they each work:

A condo is the most common form of ownership. When you buy a condo, you own one particular unit in a building. You’ll have title to the unit plus you have rights to a use the common areas. In a condo, you’ll pay a monthly homeowners association fee, and you’ll need to abide by rules & regulations (called CC&Rs). Condos can be financed with conventional mortgages (think 30 year fixed rate loans issued by major banks). Most banks that issue mortgages will loan on a condo as long as it meets their underwriting criteria.

A tenancy-in-common (aka. TIC) is a hybrid form of ownership where you own a percentage of a multi-unit building. TICs came about as a way for people to be able to band together to buy property relatively affordably in otherwise expensive cities. As a TIC buyer, you’ll have rights to live in one unit in the building. Just like a condo, you pay a monthly fee and can use the common areas. In a TIC, the rules and regulations of ownership are spelled out in a TIC agreement. Major banks do not loan on TICs (because there is no secondary market where they can sell the loans to other banks). Financing is therefore more expensive and less attractive than condos. There are a few smaller banks around the Bay Area that offer TIC loans. They often charge a fee to complete the loan, the interest rate is often much higher than a conventional condo loan, and the rate is often locked for a shorter period than conventional financing. Down payment requirements are often higher than for condos. Although TIC owners each have their own mortgage, this form of ownership does come with some additional risk, primarily surrounding payment of property taxes and potential default by a co-owner. The TIC agreement does address the risk to some degree however buyers should be fully aware of the details before buying a TIC. The upside is that the purchase price for a TIC is almost always considerably less expensive than a comparable condo.

A co-op (aka. cooperative) is a building owned by a private corporation. It is basically an elite gated community. When you buy in to a co-op, you are purchasing shares in the corporation. You’ll pay a rather hefty monthly fee for rights to live in one unit. Buyers must first be interviewed by the board of directors (ie. other owners) for approval. The interview process generally requires buyers to provide personal financial details for review. The board may accept or reject buyers for any reason. Like TIC financing, terms for co-op financing are less attractive than conventional condo financing and the number of banks that will issue loans are limited. Co-op buildings tend to be well maintained (because they usually have substantial amounts of cash in the bank). Co-ops do not allow rentals, so purchasing one as an investment property is not an option. Like condos and TICs, co-ops may have shared common areas as well as rules and regulations governing what owners can and cannot do.

—

This is just a quick summary of the differences in these forms of ownership. I’ve sold all of these types of properties and am happy to discuss the specifics with you. You can find me anytime at 415-971-5651.

Rainy days are good days for home buyers

If you’re a home buyer, the thought of touring beautiful homes on a gorgeous sunny spring day sounds like a dream, right? I mean, who wouldn’t want to visit beautiful homes basking in sunshine, surrounded by blooming flowers and chirping birds? But hold onto your umbrellas because I’ve got a hot tip for you: if you are searching for a home to buy, touring properties in the rain might just be the investigative adventure you need to try. Here’s why a rainy day tour could be your secret weapon in the home-buying game.

Generally speaking, rain should slide off the roof, down the gutters, and away from the house, right? Well, sometimes water doesn’t go where we expect it to go and you end up with ponding – basically water without a getaway plan. That water can sneak into all sorts of places it shouldn’t, like walls, foundations, garages, and basements. Nobody wants that! So, while you’re scoping out your potential new home, keep your eyes peeled for any suspicious puddles lurking around the place.

Rainy days are like a truth serum for spotting leaks. Just glance up at the ceiling and skylights as you wander through. If you notice any funky patches or paint variations, it might be worth asking about.

When the weather is wet, that usually means fewer crowds, so you can explore the home without feeling rushed. Plus, the seller’s agent is more likely to be free to answer questions.

Remember that you’re stepping into someone’s home on a rainy day so be mindful of your muddy shoes. Most listing agents will have a spot for wiping your feet or even some snazzy shoe covers.

I’m not a home inspector, but I’ve attended more inspections than I can count, and I’ve picked up some things along the way. If you’re hungry for more house-hunting wisdom, please reach out. I’m here to provide guidance and help you get your dream home. Let’s make this journey fun and stress-free!

What is a contingency when buying a home in San Francisco?

If you’ve been looking for real estate in San Francisco, you have probably heard the term “contingency”; it means “dependence on the fulfillment of a condition”. In the world of SF real estate, a contingency is simply a period of time in which the buyer can investigate a property or mortgage loan while still protecting their deposit.

Contingencies are sometimes used for property inspections like a termite inspection. Other contingencies are for mortgage loan approval, appraisal, or the sale of another property. Sellers can have have contingencies too, like finding a replacement property, but buyer contingencies are more common.

In this very frenzied seller’s market, any buyer contingency can give the seller some pause when they are considering whether to accept an offer.

It can be challenging for buyers to protect their interests while still getting their offer accepted. As I’ve written about before, disclosures are important. Seller disclosure packages (complete with inspection reports) allow the buyer to be reasonably informed about the property at the outset before submitting an offer.

Regardless of disclosures, some buyers opt to roll the dice and waive all contingencies as a strategy to make their offer more attractive to the seller. Buyers should be aware that waiving contingencies is risky. As usual, it boils down to risk tolerance and of course every buyer (and every property) is unique. If you are considering buying or selling, let’s talk about how contingencies might impact you.

Buy now or wait?

The Federal Reserve recently announced that rates are expected to decline in 2024. This is very welcome news for the many prospective buyers who have been sitting on the sidelines waiting for mortgage rates to drop below 7%. Experts believe that those buyers will come flooding back to the market as soon as mortgage rates get to the 6% range. This means that buyer demand for available homes will increase significantly, which in turn will drive up home prices (again), especially in inventory-strapped areas like Northern California.

Before that happens though, some saavy buyers are realizing that now may be the right time to make an offer on a property while most of the competition are waiting for rates to drop. Although it is true that mortgage interest rates may be higher at the moment, the purchase price will probably be much lower than it would be after rates decline and demand goes back up. Many mortgages can be refinanced after 6 months, so it may make sense to lock in a good deal on a purchase price now and refinance in 6 months. Call me or talk to your mortgage pro to discuss this strategy. It’s always tough to time a market, but for those who are watching, I believe that there are signs along the way that indicate where the opportunity may be. Whether you are considering buying a home in San Francisco or Sonoma Wine Country, I’m here and ready to help.

From SF to Wine Country (and everything in between)

For more than a decade, I’ve been incredibly fortunate to have had the opportunity to represent many home buyers and sellers throughout San Francisco. My real estate business has grown exponentially since that time as clients have called upon us to represent them in nearby counties. As a result, my team and I are excited to now include Marin & Wine Country in the areas that we serve.

In addition to San Francisco, we represent real estate clients in Healdsburg, Sonoma, Santa Rosa, Guerneville, Petaluma, Windsor, Occidental, Sebastopol, Napa, St Helena, Calistoga, Yountville, Novato, Mill Valley, San Rafael and surrounding towns. If you are considering buying or selling a home in Wine Country, Marin, or San Francisco, my team and I are here and ready to help!

Mill District has arrived in Healdsburg

Have you seen Mill District yet? Located just one block from the downtown plaza in Healdsburg, construction is underway at this new home community featuring spectacular penthouses, garden homes, and flats ranging in size from three-bedrooms to studios.

The initial 43 residences comprising the Canopy collection are available for purchase now with move-ins planned for Fall of 2023. These unique homes have the distinction of a prime location on the preserve of a heritage redwood grove, and feature architectural and interior significance created by AD100 architect Olson Kundig.

Prices range from $950k to $8.5 million.

Please reach out if you would like to arrange a private tour. 415-971-5651

Price Per Square Foot: It May Not Be As Reliable as You Think

If you are a routine grocery shopper, then you already know that comparing ‘per-unit’ pricing is a smart way to shop. If something costs .48 cents per ounce then you can easily compare different brands and sizes and quickly determine that .51 cents per ounce is likely more than you need to spend. It is logical then that the same process would apply to home prices.

Continuing with the grocery analogy, the concept works well when comparing apples to apples. Price per square foot is a good barometer to consider when looking at houses and condos that are almost identical or at least very similar to each other. This works well on a new construction cul de sac in the suburbs and in high rise buildings in the city. The challenge in SF however is that the housing inventory is very old and uniquely diverse. This means that one home is usually very different than the one next door, including the details of the interior, the exterior, the parking, the view, you get the picture.

The other challenge with price per square foot in the city is that we are often relying on inaccurate square footage figures from tax records. This means that the fundamentals are not accurate, so any comparison based on square footage would be incorrect. So while price per sq foot might seem perfectly logical, it may not really be as solid a data point as you think. Each situation is different, so let me know what you are looking for and we will take a closer look.

(Updated: June 8, 2021)

How much are property taxes in San Francisco?

I am often asked about SF property taxes, how they are calculated and when they are due. Property taxes (also known as real estate taxes, real property taxes, or secured property taxes) are calculated by taking the assessed value of the property and multiplying it by the current tax rate, as of today, the current rate is approximately 1.18%. For newly purchased properties, the assessed value is typically the purchase price. The tax bill is mailed by the tax collector once a year in the fall. You should receive the bill before November 1st. Fun fact: even if you do not receive the bill in the mail, you are still responsible to pay it.

The bill is broken into two payments, the first payment is due before December 10th and the second is due before April 10th. A penalty of 10% applies if the payment arrives late, so be sure to pay early or on time.

It is important to remember that the regular tax bill is completely separate from the supplemental tax bill that is triggered following the purchase of a property. Supplemental property tax is essentially a catch-up tax on the difference between the last assessed value and the new one (aka the recent purchase price). So if you purchased a condo for 700,000 and the most recent assessed value per the assessor’s office was 550,000 then you should expect a supplemental tax bill on the 150,000 difference. So that would look like this: 150,000 x 1.18%. There is also a variable factored in for what month your closing occurs. It often takes about 3-12 months to receive the supplemental tax bill following the purchase.

To estimate your property taxes, here is a nifty calculator.

For more details on property taxes in San Francisco, visit: https://sftreasurer.org/secured

Looking for a rental in San Francisco? Be careful!

There are lots of internet scams out there, especially when it comes to rental housing ads. I have some suggestions to help you to avoid falling victim. Here is how the fraud works… the scammer lures prospective tenants by posting very convincing ads on various legitimate rental websites using addresses and photos and descriptions of real San Francisco apartments and condos. They usually just copy the details and photos from properties that were recently advertised online for sale.

The scammer advertises these places on many web sites, often with rents that seem attractively low. Once you contact them, they will eventually ask you to provide confidential info or request that you apply or send money to them to secure your spot in order to arrange a showing appointment, don’t do it!

They even sometimes use the name of the legitimate local real estate agents and brokers. Presumably this is to confuse the prospective tenant in to thinking that they are dealing with a reputable person. Of course they conveniently include a bogus phone number and email link so that you communicate with the scammer directly and not with any actual legitimate agent.

Be sure you are using reputable rental sites (like LiveLovely.com or Trulia.com) and always keep your eyes open for red flags or things that don’t seem to add up. Although the reputable sites do get many fraud postings, they are more likely to remove those scams quickly when they get flagged.

Here is what you need to know…

If you contact an owner about an apartment and he or she is unwilling or unable to show you the apartment within a few days, move on. If there is a dramatic story about illness or death or distant family members causing a delay in the showing, move on. If the language that the “landlord” uses seems very odd to you, move on.

Never ever ever complete an application or send money to anyone until you have personally toured the apartment. Also when you do go to see an apartment, don’t go alone.

If you find a place that looks interesting, I suggest that you Google the address to see if there are other ads online for that address. Use a few versions of the address in your searches, like 123 Main Street #5, San Francisco or 123 Main St Apt 5 San Francisco. If your online search turns up some links to the same unit currently listed for sale on major real estate sites like Zillow.com or Realtor.com, then that’s a sign that the property may not actually be for rent and you are likely dealing with a fraudster. While it is possible that a property could be legitimately advertised for both sale and rent simultaneously, it is not the most likely scenario. In any event it would be easy enough to decipher by speaking with the actual agent representing the seller.

You should also Google the name of the agent, for example if the ad says to contact Patrick Lowell at Zephyr Real Estate for information, just Google that name to see if the phone number and website that you find online match what’s in the ad. If you are not sure if an ad is legitimate and you’ve searched for the agent’s name and found a phone number that is different, call it and speak with the agent. Often it is someone like me who can tell you right away that the ad is a scam and that they did not post it.

Bottom line, follow your gut, if something does not seem right, it probably isn’t. Trust your instincts.

Remember: NEVER send money or complete any application until you have toured an apartment in person.

Here is an example of an actual rental scam email, most of them follow a similar pattern:

—–

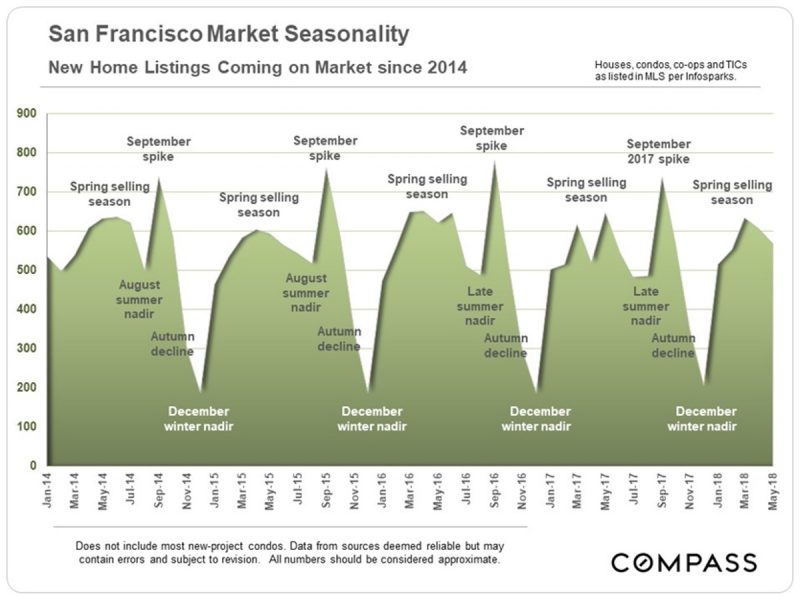

When is the best time of year to buy or sell a home in San Francisco?

I am often asked about the seasonality of real estate in San Francisco. As it has been for a long time, we are in a seller’s market in SF however there are definitely some fluctuations throughout the year.

Sellers: The majority of the year is still very good for sellers, especially for single family homes, however the best time for sellers is in September/October when the weather is usually sunny and dry and fog is nowhere to be seen. This time of year is known as “San Francisco’s summer” even though it is really autumn everywhere else. Throngs of buyers are visiting lots of open houses on these sunny weekends, multiple offers are the norm, and sale prices that far exceed list prices are very common.

Buyers: If you are buying and want to have a shot at getting a (relative) bargain, you’ll want to do that in July/August or wait until November/December (but the number of available listings will be limited). The number of buyers that you’ll compete with are usually relatively low at this time, and the resulting number of offers and sale prices will also likely be in your favor. Of course, as with most things in San Francisco, each neighborhood and price range has it’s own unique nuances, so please let me know if you need advice on your particular situation.

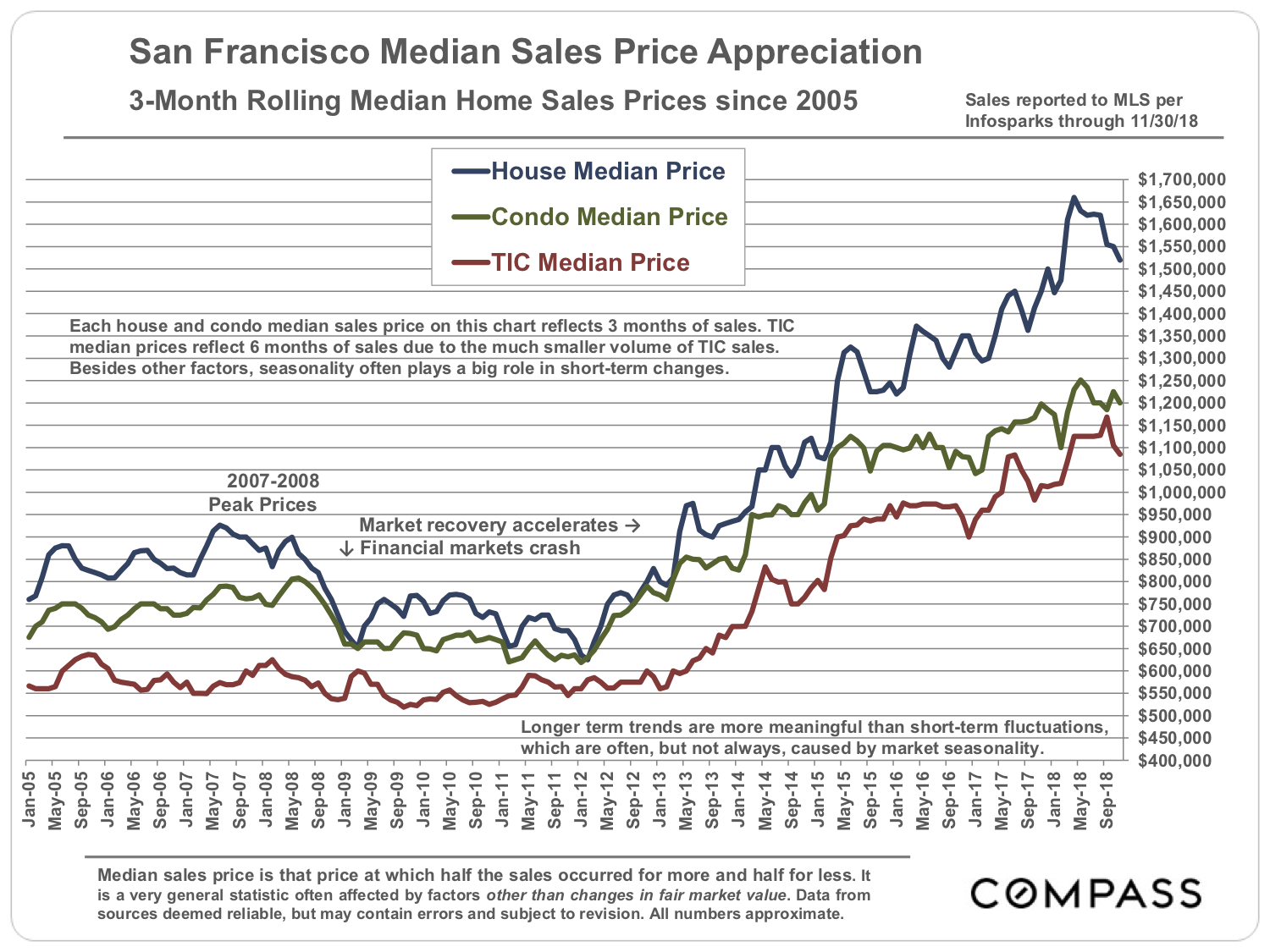

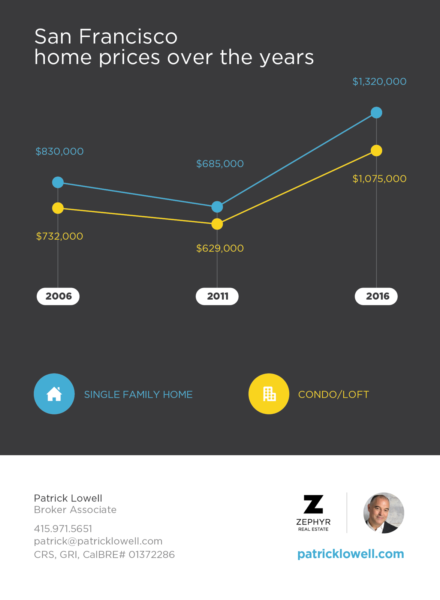

The history of San Francisco home prices

How to look up permits for any San Francisco property

Did you know that there is a site that allows you to view permits and complaints for all properties in the city? This comes in very handy if you are thinking of purchasing a home (or if you are a nosy neighbor).

Just head to Department of Building Inspection’s website and enter the property address. There you’ll see all permits relating to electrical, plumbing and building as well as the complaints that may be on file for that location.

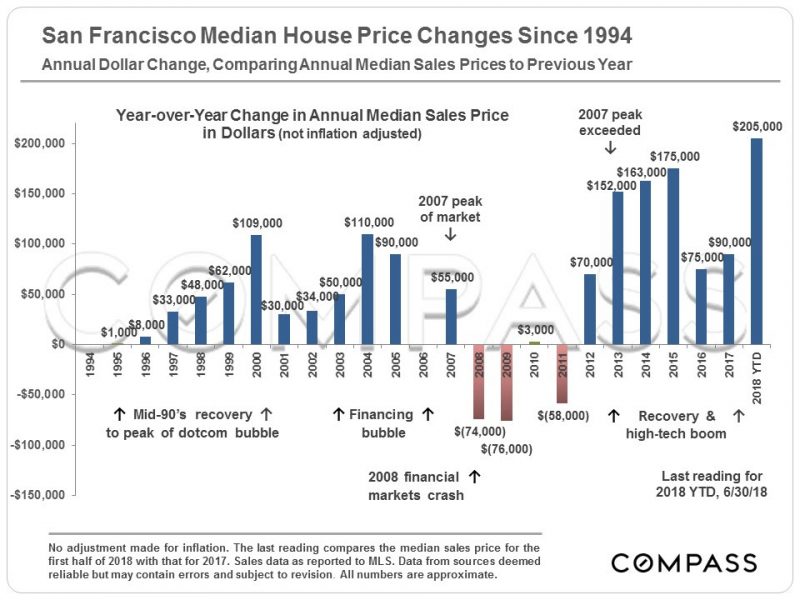

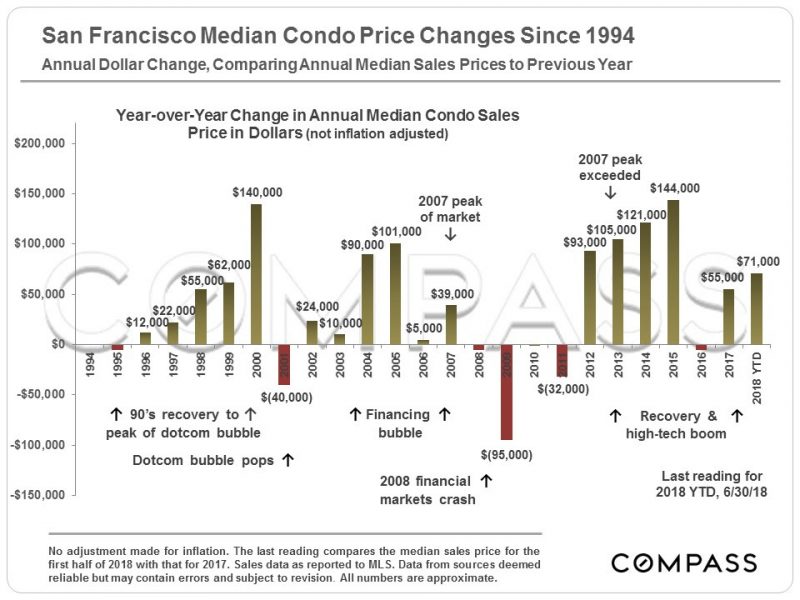

San Francisco real estate price changes since 1994

By any measure, the heat of the San Francisco market in the first half of 2018 has been among the most blistering ever. Probably only 3 or 4 other periods over the past 50 years have seen a comparable intensity of buyer demand with regard to the supply of listing inventory available to purchase. Though all segments performed strongly, the market was particularly ferocious in the lower and middle-price segments of single family homes.

Here are the median price changes for San Francisco houses and condos sold from 1994 to 2018.

Single family homes:

Condos:

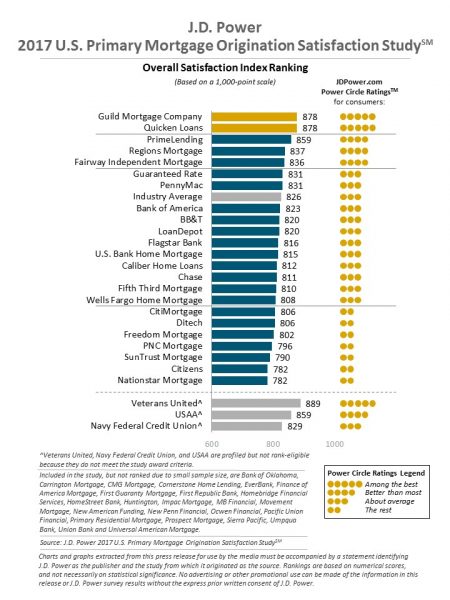

Bank or mortgage broker: Where should you get your mortgage?

If you are considering buying a home, the best first step is to get pre-approved for a mortgage so you can see exactly what you can afford before you fall in love with a new home. There are many banks and mortgage lenders that can help with your home purchase but buyers often wonder how to find the best one. Low rates and fees are definitely important but so is the satisfaction of past customers. JD Power recently published a ranking of customer satisfaction of mortgage lenders. San Francisco is a city of mostly older homes and some rather unique real estate market idiosyncrasies so it is very important to work with a lender that knows the area. I have had clients who’ve worked with some of the lenders on the list below, contact me directly and I can tell you which one may be a good fit for your particular situation. The lender you chose might actually impact whether your offer is accepted or declined so it is important to do your mortgage lender homework. I am here to help.

Tuesday Broker Tour is another opportunity to see homes in SF

It’s no secret that most open houses in San Francisco occur on weekends, especially on Sunday afternoons. That can be a real challenge for buyers who happen to be out of town for the weekend but still want to check out a property. Tuesday Tour is an open house for brokers and agents; basically it is an opportunity for industry professionals to tour available homes during the week. What many buyers don’t know however is that the public is almost always welcome to these open house events. You can check to see if a particular property is open on Tuesday by asking your agent or broker. Tuesday open house times vary depending on the MLS district where the property is located. Here is a map of the districts. Here is a list of the Tuesday open house times for each district. The subdistricts can get confusing, here is a list of those. The open house times are broken down to “new tour” and “repeat tour”. New tour is for new listings and repeat tour is for properties that have already been open at least once before. A few neighborhoods have broker tour on Wednesdays instead of Tuesdays since it was tough to see all the properties in one day. Those are: Mission Bay, South of Market, Yerba Buena, South Beach. Want to know if a property will be open on Tuesday or Wednesday? Just ask me!

After The Equifax Breach: What You Need To Know

The recent Equifax security breach makes it clearer than ever that consumers need to take data security very seriously. There are steps you can take today to maintain control of your credit and personal information. If you haven’t already placed a security freeze on your credit files, maybe you should. Here’s what you need to know.

A quick history of San Francisco real estate prices

How do I get a good deal when buying San Francisco real estate?

Buying a home or condo in San Francisco can be intimidating for buyers. The prospect of competing with dozens of frenzied buyers for that one special place can take the wind out of your sails pretty quickly. But here is some good news…

Time of year matters

The SF real estate market tends to be slowest in November and December, that can mean better deals for buyers. Less competition and lower prices are more likely during these two months than during the rest of the year. Although inventory is very limited during this notoriously quiet period, some of the listings that are available will be relatively good bargains.

Back on market, high number of days on market, price drops

Beyond time of year, there are some other ways to find potentially good deals. Watch for properties that have recently come back on the market after being in contract. Although it’s important to understand why the contract was cancelled, these situations sometimes indicate that a seller may be frustrated and more flexible on price and terms. Properties that have been on the market a while (with a high number of days on market, over 60 days) often will signal that the seller is open to some negotiating. Keep an eye out for listings with recent price reductions. All of theses are indicators that there may be a window of opportunity for the savvy buyer.

I’m happy to send you my picks of the best deals in the neighborhoods you’re interested in, just let me know.

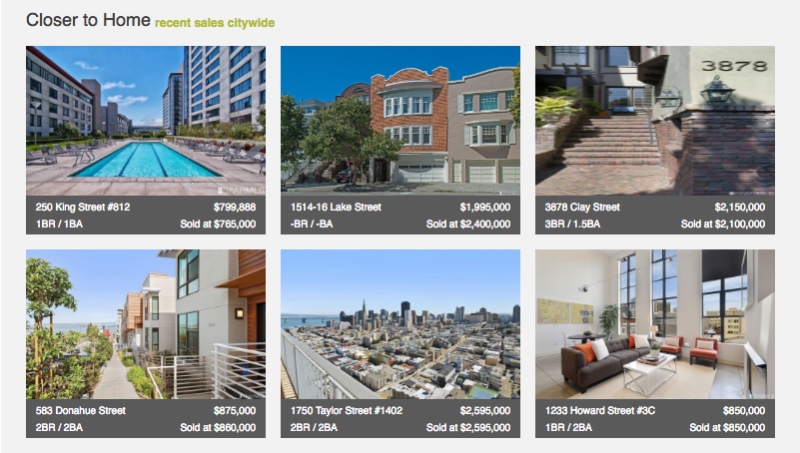

SF Real Estate Market Update May 2016

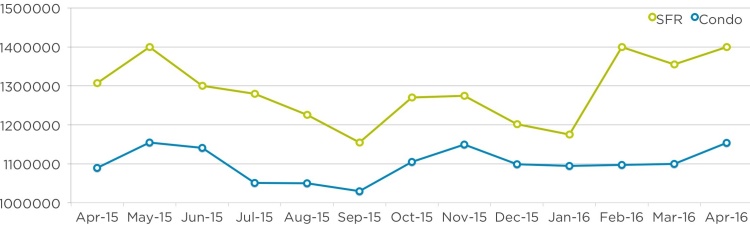

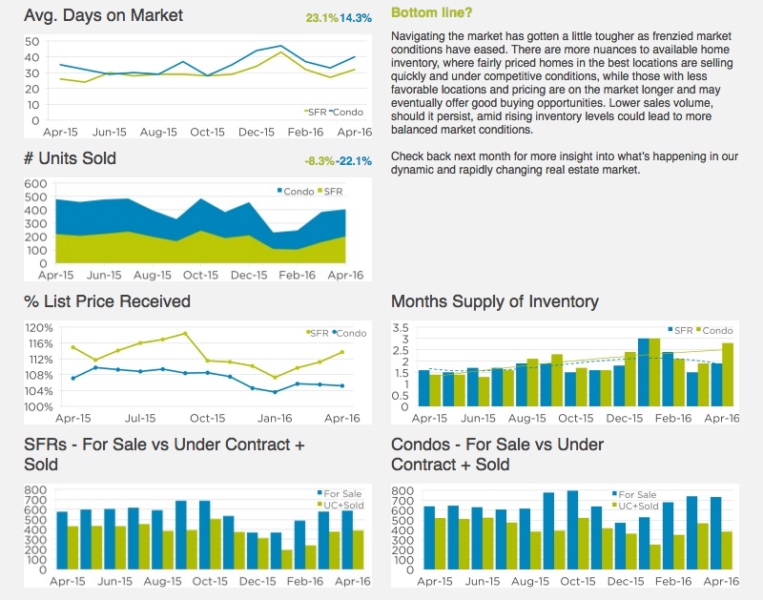

Home sales activity, representing buyer demand, is one of the most basic market trend indicators. We typically compare the same time period because home sales are seasonal, lower in the winter and summer months and higher in the spring and fall. Over the first four months of 2016, the number of homes sold declined by 13% for single family homes and 10% for condominiums versus the same months in 2015. While this does represent lower demand, reviewing other indicators will provide a better understanding of overall market conditions.

The amount of supply available, how long it takes to sell and at what price, will provide a better indication of market dynamics buyers and sellers can expect. On the supply side, the inventory of available homes for sale remains low, but it has increased compared to last year. Single family home inventory was up slightly in April 2016 versus the prior year to 587 homes. Condominium inventory year-over-year was up by 94 units or 15%. In terms of the time required to sell homes placed on the market, the average in 2016 was 35 days, four days longer than in 2015. A selling time under 60 days is considered short and seller favorable, indicating an active market. Finally, the median home price, which represents market conditions motivating a buyer and seller to agree upon a sale price, surpassed or equaled its twelve month high in April 2016.

Median Sales Price |

7.1% |

5.9% |

Patrick’s Properties

239 8th St #7

South of Market

Hip urban loft with large private patio, parking & storage

Listed at $899,000

Open house Monday, May 30th: 1pm-4pm

81 Clairview Ct

Midtown Terrace

Sweet single family home, 3 beds 1 bath

Listed at $895,000

Open house Tuesday, May 31st: 1pm-2:30pm

1350 Natoma St #7

Inner Mission

Newer townhome-style condo. 2 beds 2.5 baths, parking & storage

Listed at $849,000

Showings begin June 11th

san francisco real estate market update: April 2016

| Over the last four years, the San Francisco real estate market can easily be referred to as frenzied. The result has been a huge surge in home prices. Recent data though seems to indicate that the trend may be shifting.

Prices over the last three years appreciated by a whopping 35.02%, but looking at a year-over-year analysis, we can see that the vast majority of the gain, almost 31%, happened between 2013 and 2015. Over the last twelve months, the rate of appreciation has slowed to just 3.80%. |

| Condos & Single Family Homes Median Sale Price |  |

|||

| 2013 – 2016 / Year Over Year | ||||

|

||||

| It’s also interesting to note that most of 2013 – 2015 saw a steady smooth upward price trend but the last twelve months was filled with multiple peaks and valleys.

The underlying market dynamics haven’t really changed. Demand is high, inventory remains low, interest rates are stable, and financing is no easier or harder to secure then it was a year ago. Of course many other factors impact the housing market (local employment opportunities, the stock market, politics, consumer confidence, etc). They are each likely impacting the current market adjustment to some degree. We have all expected that the pace of appreciation of San Francisco real estate would start to cool down a bit. While we may have reached that point, I definitely do not view this as the bursting of a bubble. If you’ve been thinking of selling or buying a home, give me a call and we can chat about how this market shift could impact your real estate goals. |

|

|

|||

Patrick Lowell Patrick LowellBroker Associate, CRS, GRI BRE# 01372286 415.971.5651 [email protected] www.patricklowell.com |

|||

|

|

|||

How to buy a home in San Francisco if you are an expat

If you are considering a move to the U.S. from another country, you will quickly learn that the process of buying a home here is unique and probably even a little baffling at first. Here is what you need to know:

- Step one is to find the right real estate broker to guide you. In San Francisco, like much of the U.S., buyers and sellers each have their own dedicated broker to help them. Your broker is your primary advocate throughout the real estate purchase process and can help you to buy any available home on the market regardless of which broker is representing the seller. He or she has a fiduciary duty to represent your best interests. Sellers pay the commission which is the compensation for both brokers. Buyers rarely pay any commission at all.

- Get pre-approved for a loan. Without a U.S. credit report and social security number it can sometimes be challenging to get a mortgage loan. Here is how the system typically works: after a potential home buyer applies for a loan, the mortgage lender uses their social security number to check credit history which is pulled from three credit bureaus: Trans Union, Equifax, and Experian. Each of these bureaus collects data from various creditors like banks and credit card companies regarding an individual’s payment history, amounts owed, etc. That data is used to formulate a score called FICO which gauges an individual’s perceived credit-worthiness. The score can range from 300-850. Anything over 700 is generally considered very good. The credit bureaus and resulting FICO score only considers credit history earned in the U.S., not overseas. If you are new to the U.S., this is clearly a bit problematic. There are some alternatives for expats who are new to the U.S., so finding the right mortgage lender is key. Your real estate broker can refer you to a few lenders that can help.

- Start looking at neighborhoods and homes with your broker. This step may take a while as you learn the areas and nuances of the city along with the various property types that fit into your budget. San Francisco is geographically small but it has 89 distinct neighborhoods, so there is a lot to learn. Your broker can give you access to MLS, the database of all available homes in the city.

- Once you find the right home for you, then it’s time to make an offer. Offers are comprised of price and various terms that your broker will discuss in detail with you. Offers can be contingent upon certain events like a professional home inspection or even full mortgage loan approval. Your broker will discuss the pros and cons of various offer terms to make it attractive to the seller while still protecting your interests. The timeframe of offering on a home to actually getting keys in your hand is generally about 35 days or less.

I have represented many buyers from other countries. I’d be glad to sit down and talk with you about the process to see if buying a home in San Francisco is the right move for you. Just let me know when you’d like to meet. I can be reached at (415) 971-5651.

415.971.5651

415.971.5651

patrick@

patrick@

SF Office

SF Office